Steps to financial freedom

Published on May 23,2017

People join organisations for reasons ranging from financial to career growth, work challenge, training, location to even culture, and when the needs are met, others arise, and if not addressed, people leave and seek answers elsewhere. Getting a new job is often glamorous and enticing to the new recruit. It is often challenging and dilemmatic especially for undergraduates to manage their salaries in a fair and equitable manner.

Congratulations! You have finally earned your first salary, it feels awesome doesn't it? Before you go to the club, casino, betting or road trips and spend all your earnings and find yourself tempestuous situation, here are factors to influence you:

NOTE YOUR BENEFITS

Take a thorough check on your payslip, there are a couple of deductions on that damn payslip. Are you aware of all the deductions on your payslip? The government through your employer deducts PAYE- Pay As You Earn from your gross salary. You may also be deducted NSSF and NHIF which are very vital for retirement benefits scheme and healthcare insurance respectively. If you are a member of a Sacco or a savings scheme, are the deductions made as per your policy states? Ensure every deduction on your payslip is clear to you. If it is unclear and ambiguous to you, contact the HR manager and accountant for clear guidance. Also, try to find out whether there is a wrongful debt in your payslip.

CLEAR YOUR DEBTS

We all have debts or otherwise debtors at one point of our lifetime. The government too borrows debts to finance its massive expenditure activities such as capital expenditure and recurrent expenditure. Borrow is never a crime but it is a fraud to borrow what you are unable to pay, therefore borrowed money must be settled regardless of the circumstances. One needs to settle down and strategize on the debt payment policy using his salary without straining and stressing too much of your income. The general rule is that never spend more than 30 percent of your salary to “ service” your debts. You must always bear in mind that borrowing is the most expensive form of financing. Make essential payments like mortgage loans, rates, and higher education loans like HELB before other debts as being penalised is the last thing you would want.

BUDGET

A budget is an estimate of costs, revenues and resources over a specified period of time reflecting a reading of future financial conditions and goals. The budget serves several purposes such as:

- Plan of action for achieving quantified objectives.

- A standard for measuring performance.

- Device for coping with foreseeable future situations.

Once you know how much you exactly earn, it is better to draw a monthly budget for your cash flow.

What are your immediate expenses; rent, food, clothing e.t.c.?

What are your miscellaneous expenses?

How much do you intend to save?

Budgeting has only one rule; Do not go over budget. Don't tell me what you value, show me your budget, and I'll tell you what you value.

SAVING AND INVESTMENT

If you would be wealthy, think of saving as well as getting. Donald Trump in his famous quote says, "Experience taught me a few things. One is to listen to your gut, no matter how good something sounds on paper. The second is that you're generally better off sticking with what you know. And the third is that sometimes your best investments are the ones you don't make." The fastest form of saving is joining a Sacco and investment firms. The financial sector in Kenya, for example, has a variety of investment and pension firms that are very lucrative. Saving culture requires consistency and constant discipline otherwise the whole savings scheme would be flawed. Savings may help you to acquire expensive assets that your net salary would not have purchased at once. Savings is not about volumes but the strength and courage employed towards contributions. An investor's worst enemy is not the stock market but his own emotions. Don't let your emotions and feelings inhibit your saving culture.

PREDICAMENT ACCOUNTABILITY

Life is full of misfortunes and uncertainties. It is Monday morning you are rushing to work not to be caught in the Waiyaki Way traffic to town, unfortunately, your car gets hit by a careless matatu driver, or maybe you get a phone call from upcountry about the demise of a close relative or maybe your Celestine your daughter falls ill! What would be your reactions? Suppose it is mid month and nothing was set aside for such contingency, you would be left in despair and confusion.

It is, therefore, reassuring to know that you have some funds set aside to cater for and alleviate such setbacks. Set aside at least 10 percent of your net savings to take care of emergencies.

THRIFT SHOPPING

Saving money isn't just about putting money aside, it also applies to spending less when purchasing an item. When you are an employee of an organisation, there are various instances you can always save. For example, if you adjust your commute hours, in the long run, you will spend less. It is precisely advisable to leave early for work, pay less and save.

When Purchasing items such as clothing, furniture, electronics etc do thorough research on the prices to avoid paying more while actually, you could have paid less elsewhere. Even if it means walking all the way to Gikomba, Toy Market, Muthurwa or Kangemi do it with passion, you will have saved.

When you are employed, every penny counts wasted penny will haunt you throughout the month. Get rich slow or get poor fast based on your spending patterns.

SET FINANCIAL GOALS.

A financial goal or financial target is an objective which is expressed in or based upon money. Examples include debt reduction, sufficient wealth to retire or minimisation of tax.

Regardless of what life stage you are in, you are likely to have some short and long term personal financial goals. Setting tangible and realistic goals, following them and tracking your progress is the key to success in achieving all your financial goals.

If you are married, it is absolutely essential that you and your spouse both share the same financial goal. Develop your financial plans together to make sure both are contributing to the goal. Determining what short-term, mid-term and long-term personal financial goals is the first step. The most common financial goals are a dream vacation, a new home, college savings and retirement savings. You may also figure out how much you save monthly to meet your financial goals.

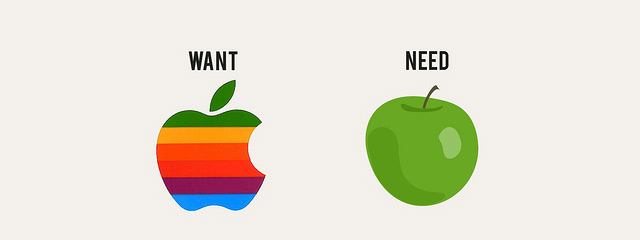

WANTS VS NEEDS

Stop buying things you don't need, to impress people you don't even like. Many people won't admit to this behaviour but given how some people go into debt and sacrifice their savings accounts in order to impress others with their bigger homes, nicer cars, and the latest fashion. If you feel you have to maintain an elaborate lifestyle to impress a specific group, you need new friends. So what if you don't own the best of everything? Learn how to live on less and you'll acquire something a lot of people don't have- a bigger BANK ACCOUNT.

I once heard someone say, "I'm always going to be broke, so what's the point in trying to save?" Coincidentally, this person is also the first to buy the newest and fancy electronic gadgets no matter the cost, and his wardrobe takes up three closets.

The secret to healthy finances is delayed gratification. You can still party, but do you really have to spend sh.12,000 every weekend? How about dinner dates, does it have to be every night after job? Why not plan it once or twice in a month and have a budget restriction on your expenditure? This way you will have saved more and brightened your future.